Choosing the right life insurance policy is one of the most important financial decisions a person can make. Life insurance is not just a legal or financial product; it is a long-term commitment that affects your family’s security, your financial planning, and your peace of mind. Among the many policy options available today, the most common comparison people face is whole life vs term life insurance pros and cons.

Both types of life insurance serve different purposes, and neither option is universally better than the other. The right choice depends on your income, age, dependents, financial goals, and long-term strategy. This detailed guide explains how each policy works, their advantages and disadvantages, and how to decide which one fits your situation best.

Understanding Life Insurance Basics

Life insurance is a contract between an individual and an insurance company. In exchange for regular premium payments, the insurer agrees to pay a death benefit to designated beneficiaries upon the policyholder’s death. This payout can be used to cover funeral expenses, replace lost income, pay off debts, or secure a family’s financial future.

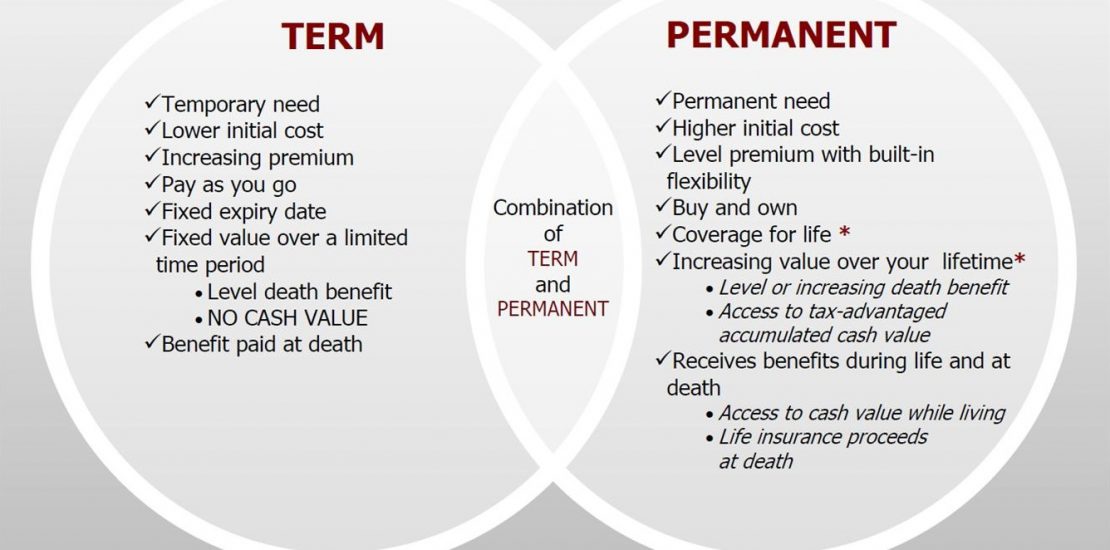

Life insurance policies generally fall into two major categories:

-

Term life insurance

-

Permanent life insurance, with whole life being the most common type

Understanding how these policies differ is essential before making a decision.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period, known as the term. Common term lengths include 10, 20, or 30 years. If the insured person passes away during the term, the beneficiaries receive the death benefit. If the policyholder survives beyond the term, the coverage expires unless it is renewed or converted.

Term life insurance is designed to offer maximum coverage at the lowest cost. It is often chosen by individuals who want financial protection during high-responsibility years, such as when raising children or paying off a mortgage.

Pros of Term Life Insurance

One of the biggest advantages of term life insurance is affordability. Premiums are significantly lower than those of whole life insurance, especially for younger and healthier individuals. This allows policyholders to purchase higher coverage amounts without straining their budget.

Another benefit is simplicity. Term life insurance is straightforward, with no cash value component or complex investment features. You pay premiums, and your beneficiaries receive a payout if you pass away during the term.

Flexibility is also a major advantage. Policyholders can choose a term length that aligns with their financial obligations. For example, a 30-year term may be ideal for someone with young children, while a 20-year term may suit someone closer to retirement.

Cons of Term Life Insurance

Despite its affordability, term life insurance has limitations. The most notable drawback is that coverage is temporary. Once the term ends, the policy expires, and no benefit is paid if the insured is still alive.

Renewal can also be costly. Premiums typically increase significantly when renewing a term policy, especially at older ages or if health conditions develop.

Additionally, term life insurance does not build cash value. Unlike whole life insurance, there is no savings or investment component, meaning the policy provides no financial benefit beyond the death benefit.

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides lifelong coverage, as long as premiums are paid. In addition to the death benefit, whole life policies include a cash value component that grows over time.

The cash value accumulates on a tax-deferred basis and can be accessed through policy loans or withdrawals. This makes whole life insurance both a protection tool and a financial asset.

Whole life insurance is often used as part of long-term financial planning, estate planning, or wealth transfer strategies.

Pros of Whole Life Insurance

One of the main advantages of whole life insurance is lifetime coverage. Unlike term policies, whole life insurance does not expire, ensuring that beneficiaries receive a payout regardless of when the policyholder passes away.

Another key benefit is the cash value component. Over time, part of the premium contributes to a savings-like account that grows at a guaranteed rate. This cash value can be borrowed against for emergencies, education expenses, or supplemental retirement income.

Whole life insurance also offers predictable premiums. Premiums remain level throughout the life of the policy, making long-term budgeting easier.

Additionally, whole life insurance can play a role in estate planning by providing liquidity to cover taxes or transfer wealth efficiently.

Cons of Whole Life Insurance

The most significant disadvantage of whole life insurance is cost. Premiums are substantially higher than those of term life insurance, which can make it unaffordable for many individuals.

Another drawback is complexity. Whole life policies involve cash value growth, dividend options, and loan structures that can be difficult to understand without professional guidance.

Returns on the cash value component are generally conservative. While stable, they may not match the returns of other long-term investment options such as stocks or mutual funds.

Finally, accessing cash value through loans reduces the death benefit if not repaid, which may affect beneficiaries.

Cost Comparison: Term vs Whole Life Insurance

Cost is often the deciding factor when comparing life insurance policies. Term life insurance offers significantly lower premiums for the same death benefit amount, especially at younger ages.

Whole life insurance premiums are higher because they cover lifelong protection and fund the cash value component. While these premiums can be viewed as both insurance and forced savings, they require a long-term financial commitment.

For individuals with limited budgets or short-term needs, term life insurance is usually the more practical option. For those with higher incomes and long-term financial goals, whole life insurance may be more suitable.

Coverage Duration and Financial Goals

The duration of coverage should align with your financial responsibilities. Term life insurance works well for temporary needs, such as:

-

Raising children

-

Paying off a mortgage

-

Covering education expenses

Whole life insurance is better suited for permanent needs, including:

-

Estate planning

-

Wealth transfer

-

Final expense coverage

Understanding your long-term goals helps determine which policy type fits best.

Investment and Savings Considerations

Whole life insurance is sometimes marketed as an investment, but it should be viewed cautiously. While the cash value grows steadily, it is not designed to outperform traditional investments.

Term life insurance, on the other hand, allows individuals to invest the cost savings elsewhere. This strategy, often referred to as “buy term and invest the difference,” can be effective for disciplined investors.

The right approach depends on your risk tolerance, investment knowledge, and financial discipline.

Tax Benefits of Life Insurance

Both term and whole life insurance offer tax advantages. Death benefits are generally paid tax-free to beneficiaries.

Whole life insurance provides additional tax benefits through tax-deferred cash value growth. Loans taken against the cash value are typically not taxable, making it a potential tax-efficient financial tool.

Tax laws vary by country and region, so it is important to consult a financial advisor for personalized guidance.

Suitability by Life Stage

Life insurance needs change over time. Younger individuals often prioritize affordability and coverage amount, making term life insurance attractive.

As individuals age and accumulate wealth, whole life insurance may become more relevant for estate planning and wealth preservation.

Marital status, dependents, income level, and retirement plans all influence which policy type is most appropriate.

Common Questions Answered

Is term life insurance better than whole life insurance?

Neither option is universally better. Term life insurance is ideal for temporary needs and affordability, while whole life insurance suits permanent coverage and long-term planning.

Can term life insurance be converted to whole life?

Many term policies offer conversion options, allowing policyholders to switch to permanent coverage without additional medical exams.

Does whole life insurance guarantee returns?

Whole life insurance typically offers guaranteed cash value growth, but returns are conservative compared to market investments.

Which policy is best for families?

Term life insurance is often preferred by families seeking high coverage at low cost during child-rearing years.

Life Insurance in a Global Context

Life insurance needs and preferences vary across regions due to economic conditions, cultural values, and regulatory environments. In developing markets, affordability drives demand for term policies, while in developed economies, whole life insurance is often used for estate planning and tax efficiency.

Understanding regional financial systems helps individuals make better-informed insurance decisions.

How to Choose the Right Policy

Selecting the right life insurance policy requires careful evaluation of:

-

Current income and expenses

-

Long-term financial goals

-

Number of dependents

-

Risk tolerance

-

Budget flexibility

Working with a licensed insurance advisor can help clarify options and tailor coverage to your needs.

Final Thoughts

The decision between term life and whole life insurance is deeply personal and financially significant. Both policies offer valuable benefits and come with certain trade offs. Term life insurance provides affordable, straightforward protection for specific periods, while whole life insurance offers lifelong coverage and long-term financial features.

By understanding the pros and cons of each option and aligning them with your personal goals, you can choose a policy that offers security, confidence, and peace of mind for the future.